Straight-Line Depreciation Method Questions on Business Exam

Recall that Depreciation is a mechanism for “recovering” or “charging against income” the cost of Equipment, Real Estate, and Leasehold improvements over their useful life. There are two methods used depreciating. Straight-Line Depreciation is one of them.

A typical business question on a contractor’s test will ask you to calculate the depreciation per year, the depreciable base, or even the salvage value of an asset.

You can calculate any of those figures simply by knowing how straight-line depreciation works.

- The value of the asset minus the salvage value equals the depreciable base. If the asset is $40,000 and has a salvage value of $6,000, then the depreciable base is $34,000.

- You are typically given or are asked to find the useful life of the asset in question. Let’s assume it is 10 years for this particular example. This means that the depreciation per year is $34,000 divided by 10, or $3,400.

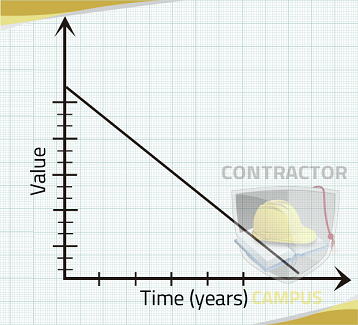

Notice that when plotted on a graph, straight-line depreciation looks like a straight line, hence the name.