Declining-Balance Depreciation Method Questions on Business Exams for Contractors

Recall that “Declining-Balance Depreciation” is one of the two depreciation methods used, with “Straight-Line Depreciation” being the other.

In straight-line depreciation, assets are depreciated by the same amount every year, for example, an asset with a useful life of 5 years depreciates or follows (straight-line):

How is Declining-Balance Depreciation calculated and why is it used?

Declining-balance depreciation is used because it better reflects the loss of value suffered by heavy equipment used in construction, which lose most of their value within a few years.

To calculate Declining-Balance Depreciation, follow these steps:

- Full cost of Asset/Useful life (years) = Straight-Line Depreciation.

- Straight-line depreciation times Declining Balance Percentage = Declining-Balance Depreciation.

*Note that Declining Balance Percentage is a figure that’s given to you or that you have the ability to find. - In declining-balance depreciation the depreciable base is reduced every year full cost minus This year’s depreciation equals Adjusted Depreciation Base.

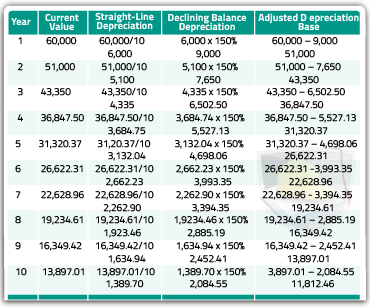

So, let’s look at a problem using the information below, evaluate the adjusted depreciation base for years 1 through 10.

Full cost = $60,000

Useful life (years) = 10

Salvage value = $10,000 | *Note this Salvage value is ignored when using the declining balance method

Declining-Balance Depreciation Percentage = 150%

*Note that this value is either given or you have the ability to find it during testing.

Notice that graphically, if the asset’s value is plotted with respect to time, the resulting curve has a more significant drop towards the beginning.