Calculating Withholding Allowances on a Contractor's Business Exam

There are several methods of evaluating income tax withholding, there are:

- Wage Bracket Method

- Percentage Method

- Alternate Methods

All these methods can be used just knowing the information on an employee’s W-4, the Wage Bracket and Percentage Methods are enough to answer any question about withholding allowances on a construction business exam.

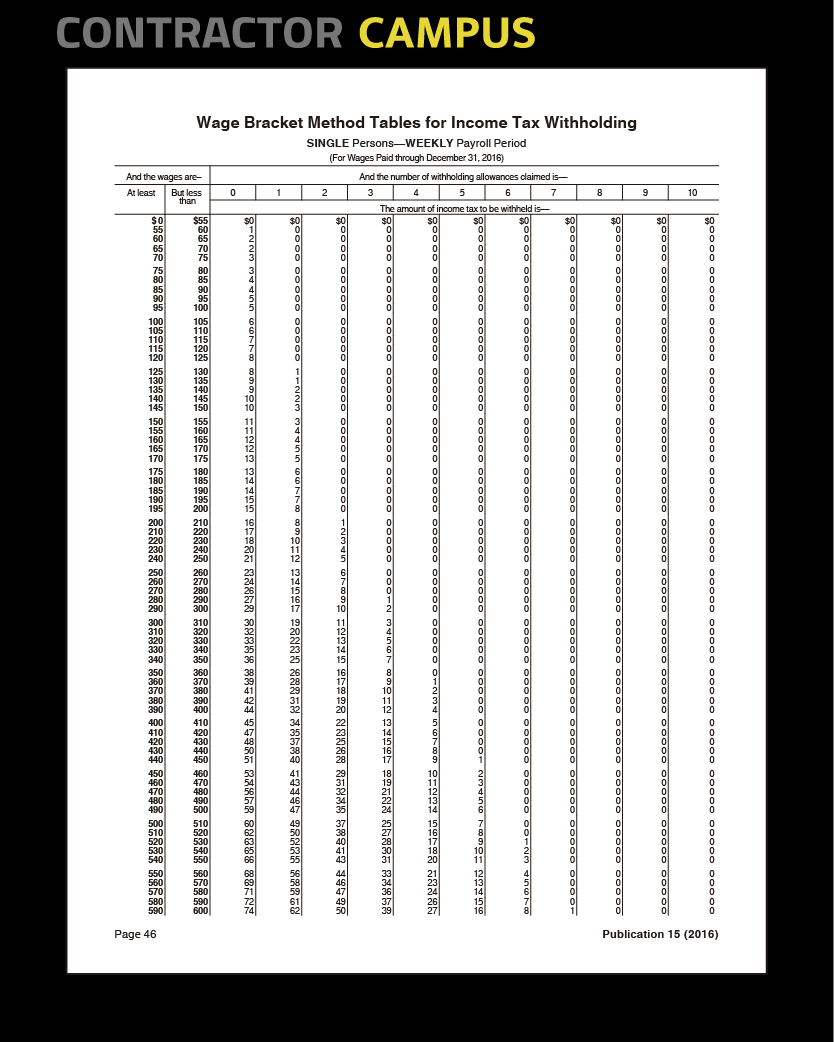

Wage Bracket Method

- Find the proper table on the back of the circular E**. To pick the right table you need to know the marital status of the person (single or married), and the frequency of pay (weekly, biweekly, month, etc.)

- **Please note that the 2020 change on the content of W-4 forms creates a split on where to find the tables referenced in these calculations. The classical way of doing these calculations is based on the pre-2020 w-4 and it is the most common type of withholding question you currently encounter in contractor business exams. If your primary business book has a post-2020 circular E, you'll notice that the tables listed here do not appear anywhere, but do not panic! You will be given the table(s) that you need within the test question (you need that information in order to calculate withholdings). In those cases (post-2020 Circular E), the information that they'll give you within the question will come from a post-2020 Publication 15T (Federal Income Tax Withholding Methods). The calculations are very similar though, so make sure you understand the dynamics of the solution, you'll need to come up with the answer whether you have a pre or post-2020 Circular E.

- Identify the number of withholding allowances explained by the employee in her W-4 form.

- Identify the wage range that the employee falls under. For example, 500 to 510 dollars per week

- Find the intersection between the row containing the wage range and the column containing the month of withholding allowance claimed.

- The intersection found on step 4 contains your answer, the dollar amount which must be withheld from the paycheck.

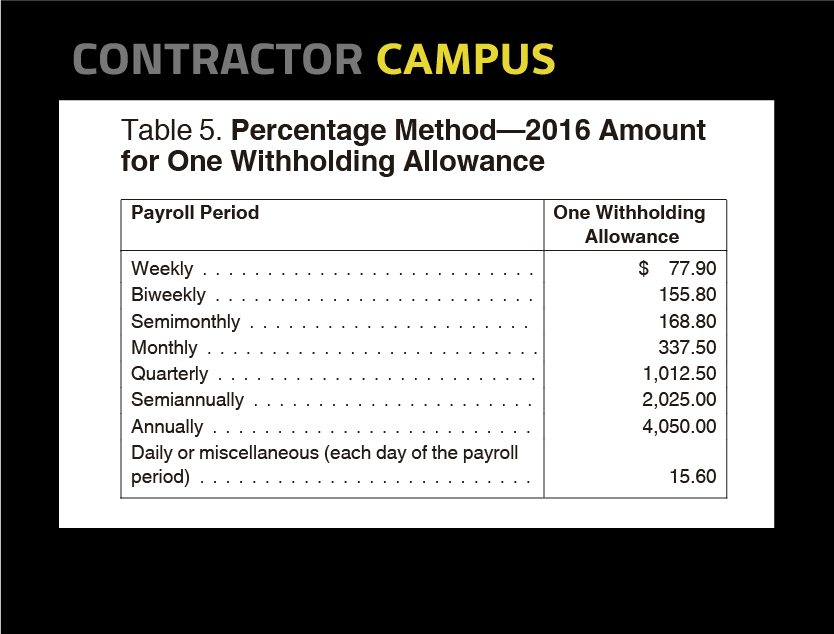

If your problem has more than 10 withholding allowances, then you must follow these steps instead:

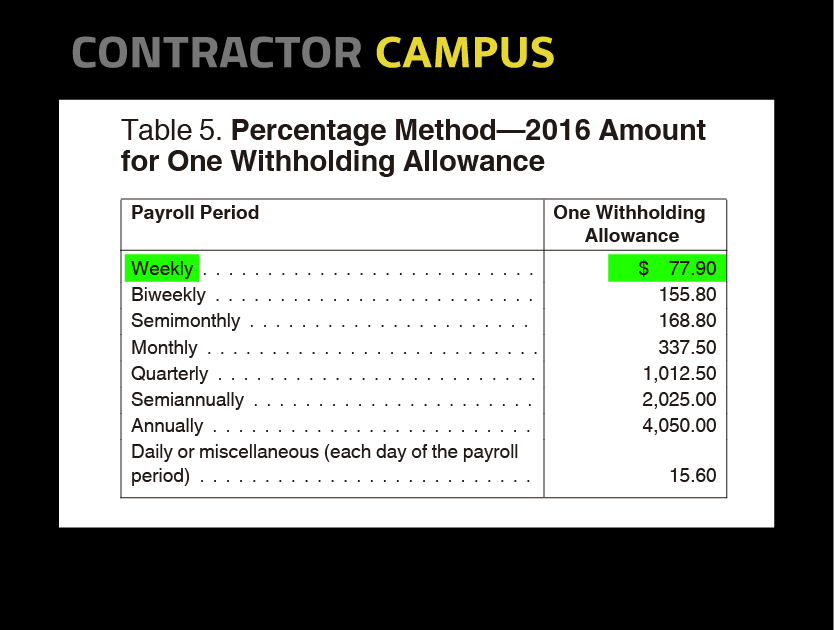

- Multiply the number of withholding allowances over 10 by allowance value in Table 5. The name of this is “Percentage Method – [year] Amount for One Withholding Allowance”

- Subtract the result from the employee’s wages.

- On this amount, find and withhold the tax in column 10 for allowances.

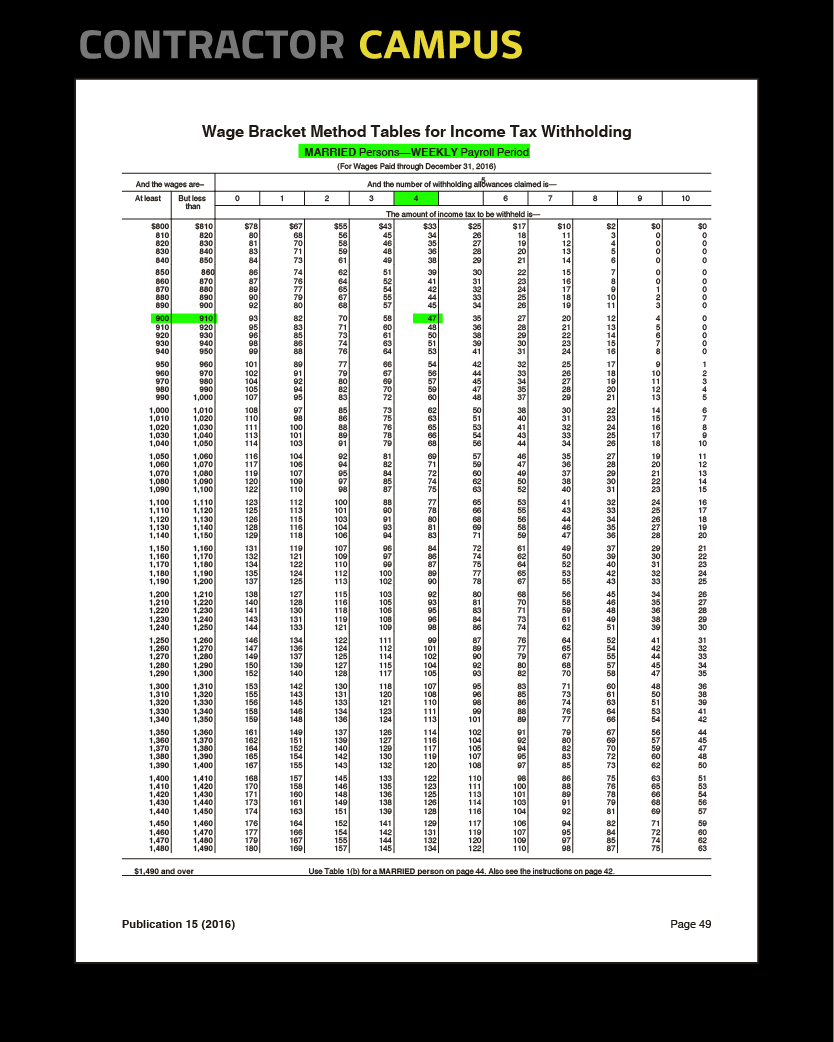

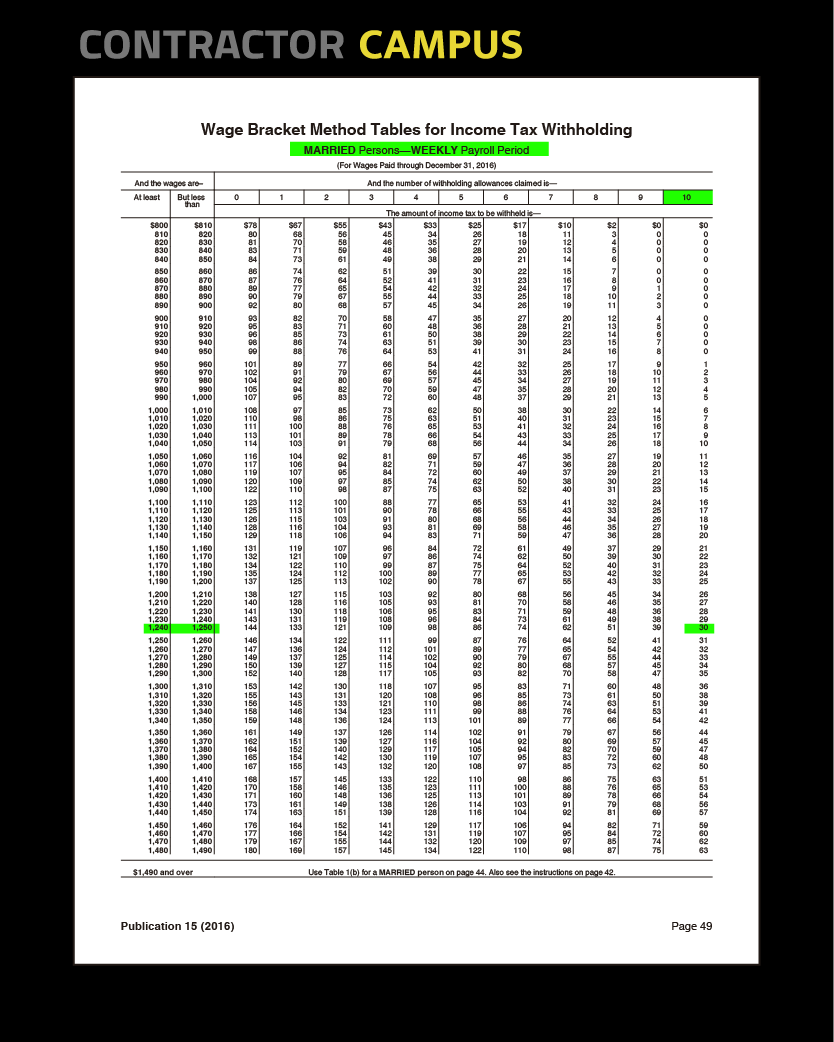

Example 1: Use the wage bracket method to determine the income tax withholding for Craig Smith. He is married, gets paid weekly and makes $900 per week. On his W-4 form. He claims 4 withholding allowances. Solve using the 2016 circular E (Note that on your test, the answer will be looked on the circular E you are using. Your business book has within it a circular E excerpt)

- Identify the correct table (married, weekly)

- Locate the number 4 on the top row, that’s the column you will be working with

- Locate the wage range using the first two columns. Notice we must pick “900 910”. We cannot use “850 860”, this is the row you will be working with.

- Locate the intersection of column “5” and row “850 860”

- The intersection is “47”, $30 is the amount to be withheld our answer!

Example 2: Use the Wage Bracket Method to determine the income tax withholding for Karl Smith. He is married, gets paid weekly and makes $1500 a week. On his W-4 form he claims 11 withholding allowances.

- The number of withholding allowances over 10 in 1 (11-1). One weekly allowance is $77.90, we find this by looking at the correct row within Table 5.

2 times $77.90 = 155.80 - Subtract $155.80 (the result of steps) from the employee wages, $1500. $1500 – 77.90 = 1,422.10

- On the amount calculated in step 2, calculate the withholding based on 10 withholding allowances, this means we must fund the intersection between row “1240 1250” and column “10”. The answer is “54”.

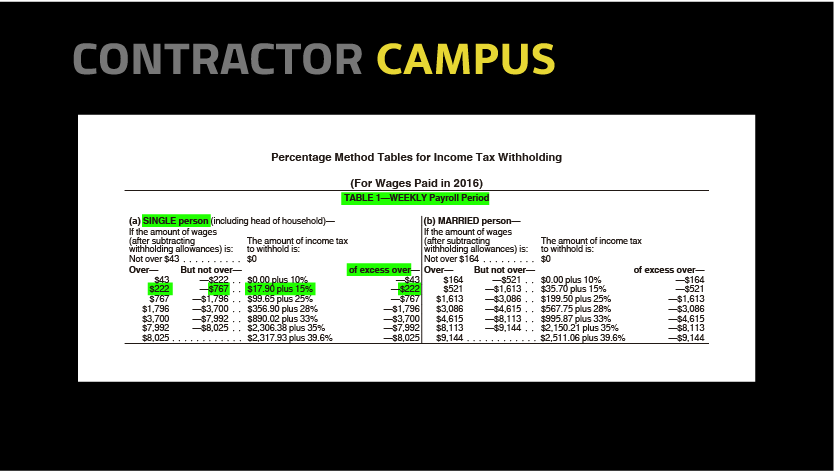

Percentage Method

The percentage method works with any amount of wages and any number of withholding allowances. To use this method (dollar amount), follows these steps.

- Multiply one withholding allowance for the correct payroll period times the number of allowances claimed. The number of allowances claimed to come from the employee’s W-4 form and the dollar amount of one withholding allowance comes from table 5 (Percentage Method – Amount for one withholding allowance)

- Subtract the amount from the employee wages

- Determine the amount to withhold for the appropriate table.

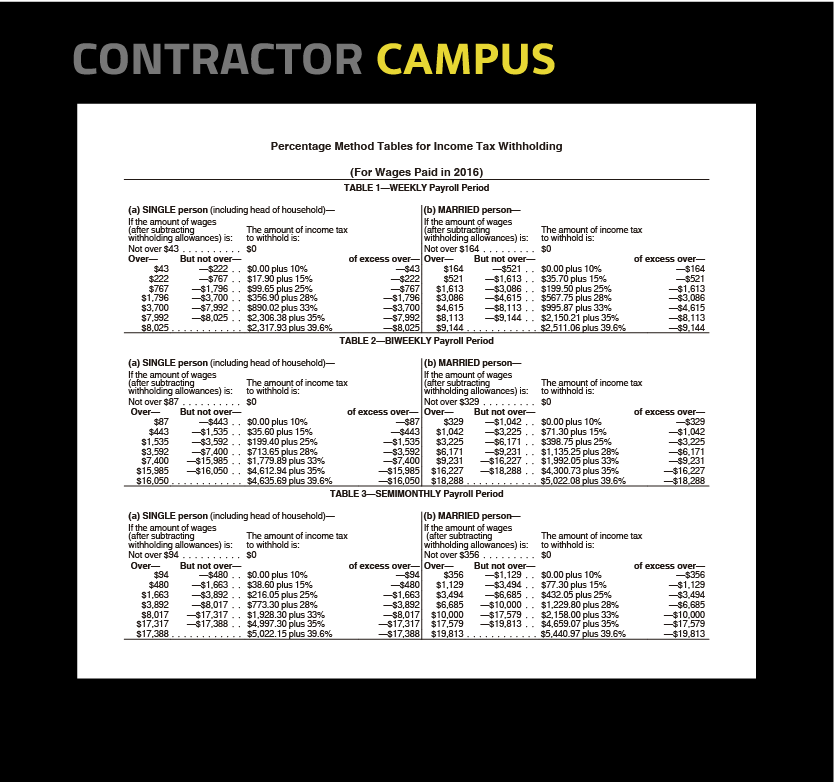

Example 3: Jim Beam gets paid $900 weekly and is unmarried. She has claimed two withholding allowances. Use the percentage method to calculate the amount to be withheld. Note that for this solution we will use numbers from the 2016 Circular E.

- From table 5, we know that one withholding allowance for weekly is $155.80. (Multiply $155.80 times 2 (2 is the number of withholding allowances claimed)

- Subtract the answer of step 1 from the wage amount. 900 – 155.80 = 744.20

- The appropriate table is “table 1 – weekly Payroll Period”. The left side of the table is for Singles and the correct row is $222 $767”, which says “$17.90 plus 15% of the excess over 222”

She makes $578 in excess of 222 (744.20 – 222 = 522.2)

17.90 plus 15% of 522.2

17.90 plus 78.33 = $96.23